Why a strong dollar is bad for US stocks?

Things usually get better after the dollar peaks, and it may soon...

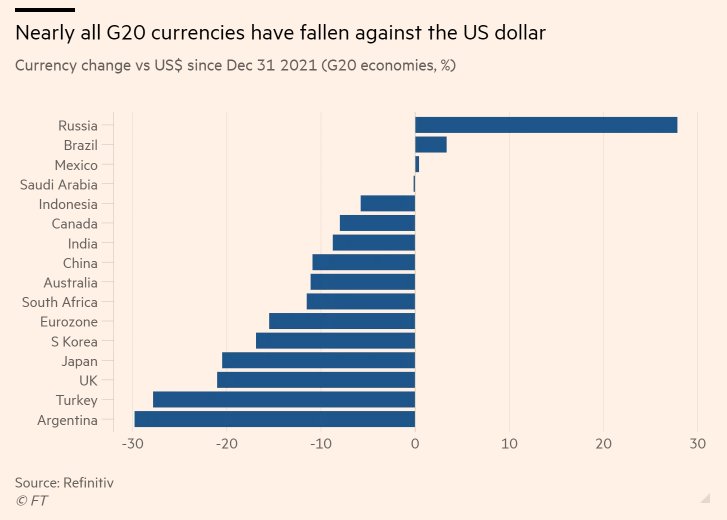

Why is this happening? Since 2020, the world economy has suffered four connected shocks: the pandemic; a huge fiscal and monetary expansion; to post-pandemic supply side, in which pent-up (and lopsided) demand hit supply constraints in industrial inputs and commodities; and, finally, Russia’s invasion of Ukraine, which hit energy.

With mortgage rates recently hitting 7% we expect the dollar to soon peak, with rate hikes largely done by the end of the year. This could act as a positive catalyst for stocks.

Why the strong dollar is bad for US stocks:

1. The strong dollar makes US exports more expensive and therefore less competitive in international markets. This can lead to decreased demand for US products and in turn, lower stock prices.

2. A strong dollar can also lead to lower prices for imported goods become more competitive. This can hurt corporate profits and in turn, stock prices.

3. Finally, a strong dollar makes it more expensive for US companies to borrow money. This can lead to higher interest rates and decreased demand for US stocks.