What Happened At Silicon Valley Bank & Does Disney Have a Liquidity Problem?

Plus this weeks economic calendar and earnings

Investors will be primarily focused on banking stocks on Monday given the failure of Silicon Valley Bank, but Tuesday will again bring attention to inflation when the U.S. Bureau of Labor Statistics releases the February consumer price index. Analysts are predicting a 6% year-over-year rise in the index, which would mark a slight decline compared to the 6.4% seen in January. Additionally, the core CPI, which omits volatile food and energy prices, is likely to show an increase of 5.5%. Federal Reserve Chairman Jerome Powell has recently stated that he wishes to see a decrease in services inflation, not including the cost of shelter.

This brings up an important topic, given something in banking has broken and if inflation continues to fall, we could see interest rates drop from their highs through the remainder of the year. This scenario would benefit growth stocks and long term bonds most.

On Tuesday, Lennar will also announce their quarterly results, and other companies such as Adobe, Dollar General and FedEx will follow with their own earnings reports throughout the week. The week will conclude with the University of Michigan's consumer sentiment index for March, which is predicted to be around 67.4, the highest reading since last year.

Of interest to our clients will be Jabil’s earnings Thursday morning. We have owned this name for a number of years on the thesis that the outsourced electronics manufacturer will continue to be a beneficiary of production leaving China. Jabil is also a significant Apple supplier, constituting about 20% of revenue, they build the AirPods, a must have item for many consumers. Jabil currently trades at a NTM PE of 9.4x, pays a dividend of 0.39%, and has an attractive PEG Ratio of 0.46x according to FactSet.

What happened at Silicon Valley Bank?

Silicon Valley-based lender SVB (SIVB) faced a major selloff Thursday as investors reacted to news of the company selling assets at a loss and a decline in deposits. Shares of the company plummeted 60%, the largest percentage decrease ever for shares in the S&P 500. The selloff caused a ripple effect, causing the KBW Nasdaq Bank Index to drop 7.7%, its worst showing since June 11, 2020.

Young, growth-oriented companies have had a difficult time accessing funding over the past year as the Federal Reserve raised interest rates. This led to these companies rapidly withdrawing their deposits from the bank, resulting in the bank having to sell assets at a loss to cover the withdrawals. This sparked a run on the bank, ultimately resulting in its receivership by the federal government. The bank has had to sell securities (long term bonds) in order to alleviate the issues caused by the current economic climate.

The cause of this steep decline is twofold: a rise in interest rates, which increases the cost of the deposits SVB uses to fund loans, and a decrease in venture capital firms funding start-ups, which supply the bank with deposits. In response to these trends, SVB announced a series of cost-cutting measures on Wednesday. As of February 28, SVB had client funds of $326 billion, a decline from $341 billion at the end of last year.

Silicon Valley Bank took drastic action in light of declining deposits. After Wednesday’s market close, SVB sold off its entire $21 billion portfolio of U.S. Treasury and mortgage-backed securities classified as available for sale (AFS). This decision resulted in an after-tax loss of $1.8 billion, to be recorded in the first quarter of 2023. As interest rates rise, the prices of fixed-income securities such as MBS and Treasury debt fall. SVB had to make a difficult decision in order to a failed attempt to safeguard its financial stability.

Since the Federal Reserve started to increase interest rates to combat inflation, banks have been dealing with a potential risk in the market. The risk comes from banks having to sell off their available-for-sale (AFS) securities in order to raise money. Clients are spending their deposits, a low-cost source of funding, which has left banks needing to look elsewhere. As bond prices drop, the banks have to sell the securities at a loss.

On Monday, depositors will likely to be protected and have access to their accounts, there is precedent for this, the Bank of New England failed in 1991. When Powell worked at the treasury, the treasury coordinated with the FDIC and The Fed to protect all depositors. It wouldn’t even cost the tax payers money, because SIVB has the assets, just not the liquidity for its bank accounts.

ls Disney having liquidity issues too?

The current and quick ratios of Disney being less than 1 could suggest that the company is having difficulty maintaining liquidity and is relying on debt to finance operations. This looks be a result of Disney's increased investment in inventories, which could suggest that the company is expecting a future increase in sales. However, if the increase in sales does not occur, then the company's debt could become more difficult to manage. As a result, investors should be aware of the potential risks associated with Disney's short term leverage. Additionally, a decrease in cash could be a sign of financial strain, as it could suggest that the company is unable to generate adequate cash flows. This could have a negative effect on Disney's stock price, as investors may be less willing to invest in a company that is struggling to manage its financial operations.

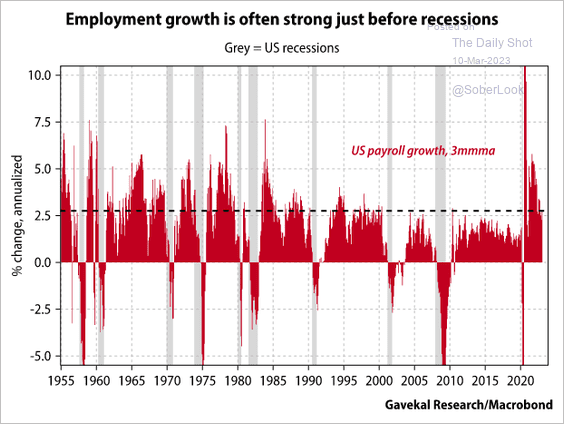

Chart of the Week: Employment growth tends to be strong before recessions

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.