The S&P 500 Makes a Swift Move to 5k

Week in Review

Last week, the S&P 500 achieved a momentous milestone, surpassing the 5,000 mark and establishing a new record high for the index. As the primary barometer for U.S. large-cap stocks, this achievement serves as a testament to the market's remarkable resilience and strength, particularly in the face of interest rate risks and political uncertainty. The consumer and the implications of AI investments continue to be positive catalysts.

It Just a year ago, fears of an impending recession were dominating the conversation. However, in a surprising turn of events, there have been more online searches for "Taylor Swift" in the finance category of Google trends than for the term "recession". This not only highlights the rise of Taylor Swift as a cultural icon, but also the overall improvement in economic growth and inflation outlook.

Having defied expectations for a slowdown and with equites getting a 20% surge in the past three months, investors are now pondering the next course of action.

Economic & Earnings Calendar

As the earnings season continues, over 60 companies from the S&P 500 are scheduled to report their quarterly results this week. Among these are well-known giants such as Coca-Cola on Tuesday, Cisco Systems on Wednesday, and Applied Materials and Deere on Thursday. These companies, with market capitalizations exceeding $100 billion, will provide further insights into the overall health of the market.

We own both Airbnb and Sony in our client equity accounts. Airbnb is expected to generate over $2 billion in revenue and the options imply a move of over 8% in the stock next week. Sony is expected to have moved over 8.9mm PlayStation 5 units and option imply the stock will move over 5% after earnings.

With more than half of the S&P 500 index companies already reporting their fourth-quarter earnings, the economic focus now turns to the release of January's consumer price index on Tuesday. Economists anticipate a 2.9% year-over-year increase in the CPI, which is half a percentage point lower than the reading from December.

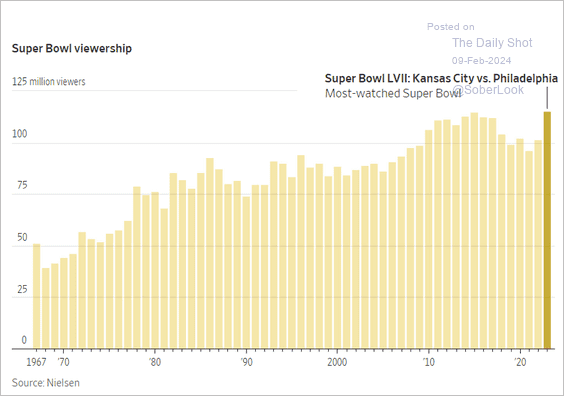

Chart of the Week: Super Bowl viewership by year

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.