The Next Phase of the Bull Market May be Driven by FOMO

Week in Review

Stocks continued their upward trend on Friday, with the S&P 500 rising 0.1% to secure its fourth consecutive week of gains. This marks the longest streak of weekly increases since August 12, 2022.

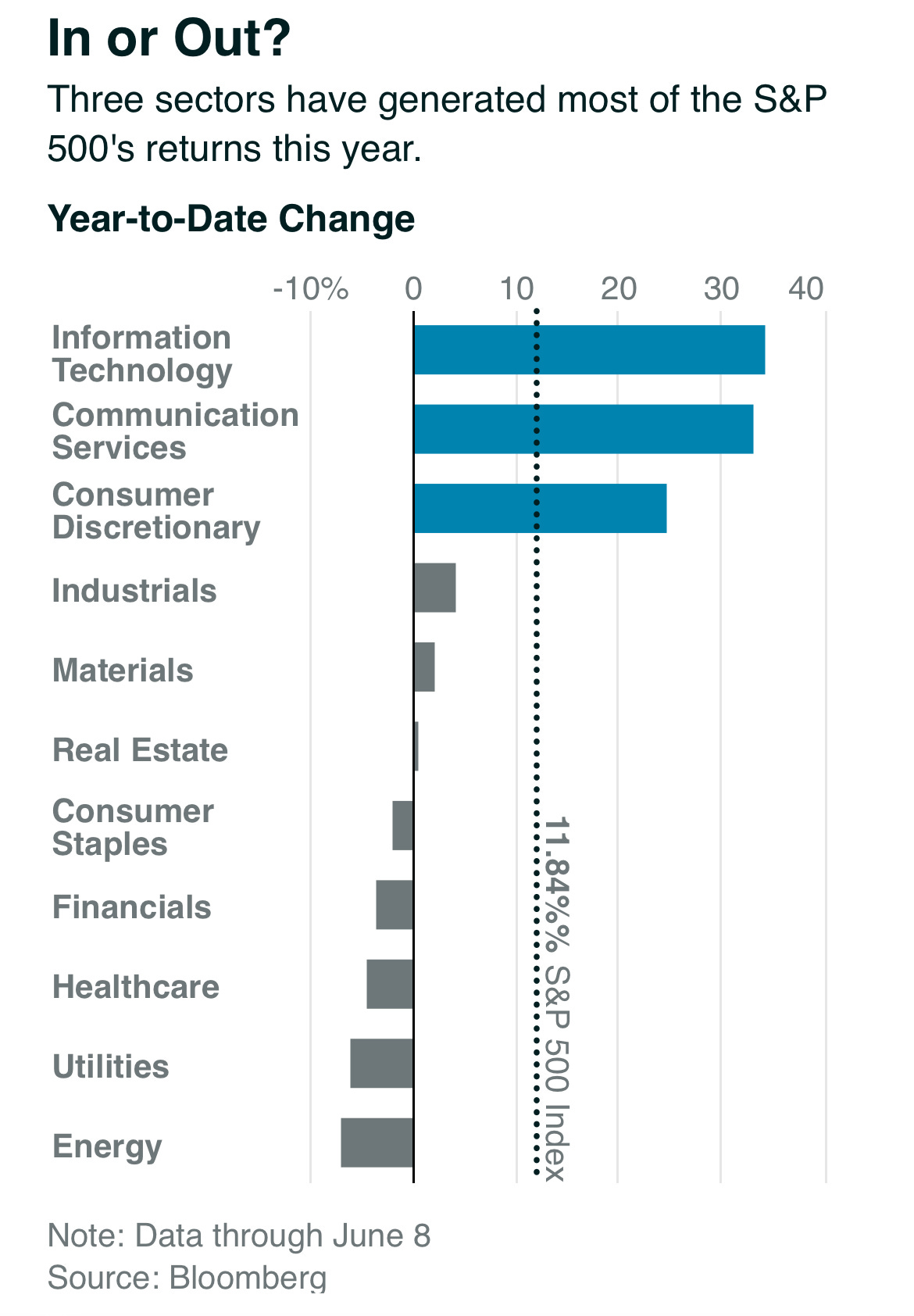

Tech stocks have been leading the charge all year while other sectors such as energy, transportation, and banks have lagged behind. Most higher dividend sectors have underperformed since the start of the year.

Emerging market stocks also surged 1.54% last week, likely on the prospect of a weaker dollar (which is good for US exports).

Investors are now keeping a close eye on the Federal Reserve's upcoming interest rate decision on June 14th, with the current odds of the rate remaining steady at 71%.

The upcoming consumer price index for May will be a critical test that could significantly affect markets. If it shows a red-hot inflation rate, it could spell trouble for those who are expecting the Fed to remain dovish. On the other hand, signs of a cooling could send stocks soaring even higher.

The US stock market has seen a remarkable decline in volatility levels as well, despite lingering economic concerns about inflation and interest rates. This marks the lowest levels since the start of the coronavirus pandemic, creating a sense of optimism in the current financial climate.

Earnings & Economic Calendar

Next week is a significant one for economic data and policy. Investors will be taking into account major inflation data, central bank meetings, and other economic and earnings releases.

On Tuesday, the Bureau of Labor Statistics will report the consumer price index for May, with the consensus estimates predicting an increase of 4.2%. Following this, the producer equivalent will be reported on Wednesday, with the consensus estimates forecasting an increase of 1.5%.

The National Federation of Independent Business' small business optimism index for May will be reported on Tuesday, followed by the Census Bureau's retail sales data for May on Thursday and the University of Michigan's consumer sentiment index for June on Friday.

On Wednesday, the Federal Reserve's monetary-policy committee is anticipated to announce a pause in interest rate hikes, as the futures markets suggest. This will likely be the most important market news of the week and we share the view that the Fed is likely to pause.

If the Fed keeps interest rates at their current level throughout 2023, it could help fix the current stock market issues, including the high price/earnings ratio of the S&P 500. Currently, the S&P 500 is trading at 18.6 times its 12-month forward earnings, slightly lower than it was at the end of 2021 but still higher than its 20-year average of 15.7. If the Fed does not increase interest rates, investors could be willing to pay higher P/E ratios, allowing stock prices to stabilize or even increase. Analysts have even suggested that the S&P 500 could rise to 4550 by the end of year, with investors paying 20.7 times for earnings which are only expected to grow slightly.

As the markets continue to rebound from the pandemic, investors are maintaining a generally bearish attitude. According to the American Association of Individual Investors, bears outnumber bulls by nearly eight percentage points, despite the fact that bulls usually outpace bears by 6.5 points. The RBC Capital Markets survey also shows that since Covid-19 hit, investors have been no more than thirty points net bullish, which is much lower than the typical pre-pandemic peak of fifty. In addition, leveraged funds are nearly as short as they were during the pandemic.

At the same time, however, the S&P 500 has gone up 11.5% in 2023, leading to the possibility that investors who are bearish may have to start buying in order to keep up with the market, pushing it up even higher. It appears that many investors may have prepared for a bear market that already occurred and may now have to adjust their strategies.

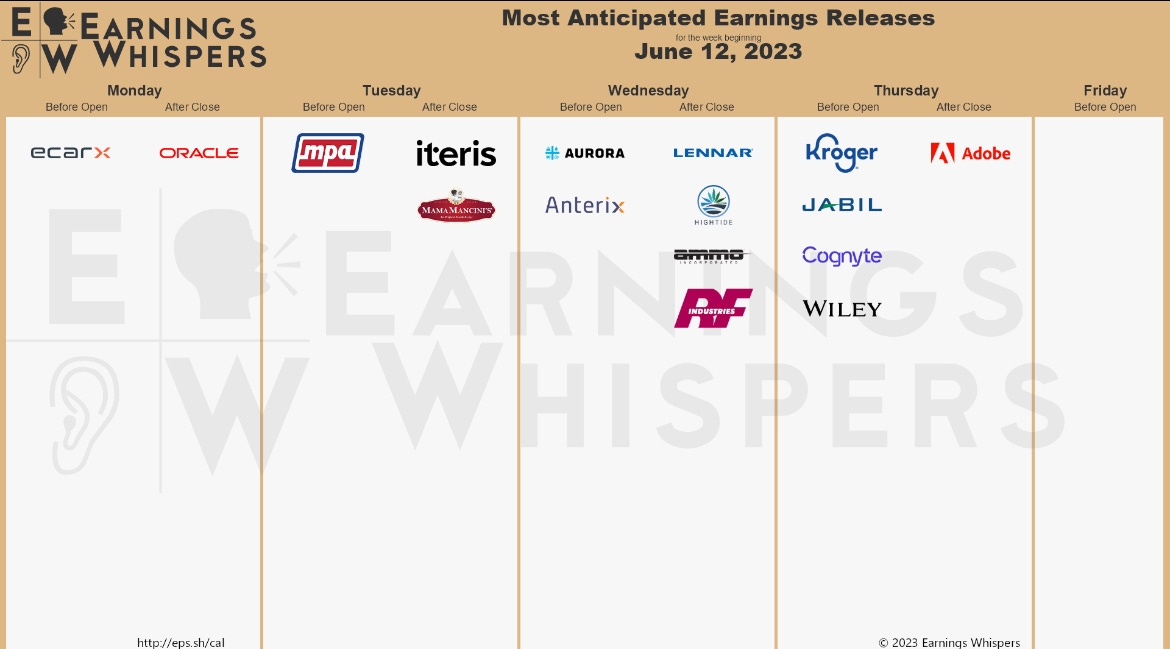

Earnings reports will be light this week and come from Oracle on Monday, Lennar on Wednesday, and Adobe and Kroger on Thursday. Home Depot will also host an investor day on Tuesday.

Long time WinCap Financial client holding, Jabil, also reports on Thursday. Why have we owned Jabil for close to 3 years?

Diversified Business: Jabil engages in the provision of electronic manufacturing services and solutions. The firm operates through the following segments: Electronics Manufacturing Services and Diversified Manufacturing Services. The Electronics Manufacturing Services segment focuses around leveraging IT, supply chain design and engineering, and technologies largely centered on core electronics. Their contract manufacturing model also benefits from firms attempting to exit manufacturing in China.

Key Partnerships: Jabil is always innovating and developing new solutions for its customers. This keeps the company ahead of the competition and ensures that customers have access to the latest technologies. According to FactSet, Jabil’s 3 largest customers are Apple, Carnival, and Nvidia. Carnival probably seems out of place, but with all the technology on new or refurbished cruise ships it is not a surprise. About 20% of revenues comes from Apple and their involvement in the AirPods.

Valuation: Jabil has a strong balance sheet with solid cash flows. Currently, JBL trades at 10.6x next years earnings (PE) with an attractive PEG ratio of 0.5x according to FactSet. Over the last 5 years revenue has been growing over 10% a year with net income growing at an astounding 50% a year. JBL pays a modest dividend for a tech stock at 0.3%

Chart of the Week: The S&P is on the verge of a technical bull market.

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.