The Fed Meets This Week on Interest Rates & A Monster Week of Earnings

The Fed Meets This Week on Interest Rates & A Monster Week of Earnings

Week in Review

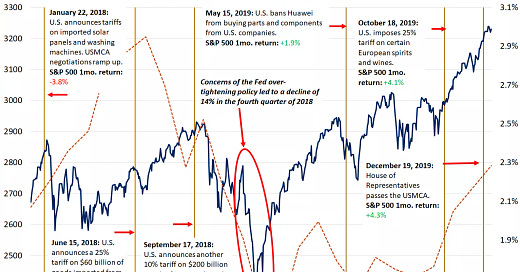

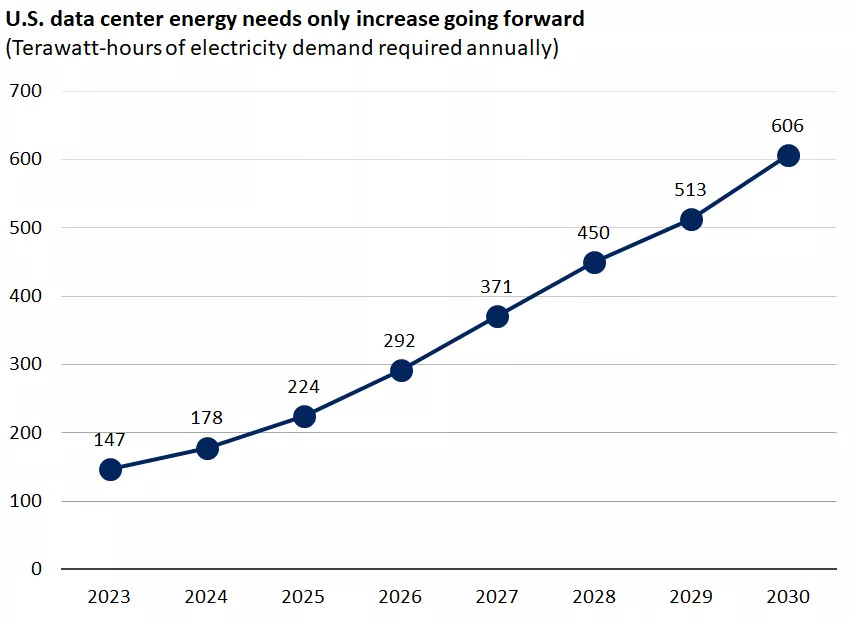

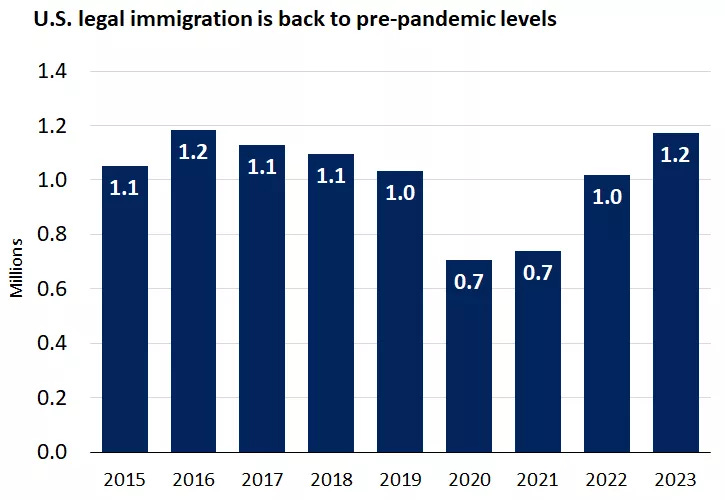

On his first day in office, President Trump signed a historic 26 executive orders, surpassing any previous administration. From a macroeconomic viewpoint, these orders concentrated on four key areas: energy, immigration reform, tariffs, and technology. While the new policies were more restrained than expected—much to the stock markets' relief—we anticipate periods of market volatility as further policy updates emerge.

The forthcoming policy proposals are likely to address tariff implementation and the administration's pro-growth agenda, which includes deregulation and tax cuts. As we progress through the first 100 days of the new administration and beyond, investors should heed the advice to "avoid letting politics influence investment decisions."

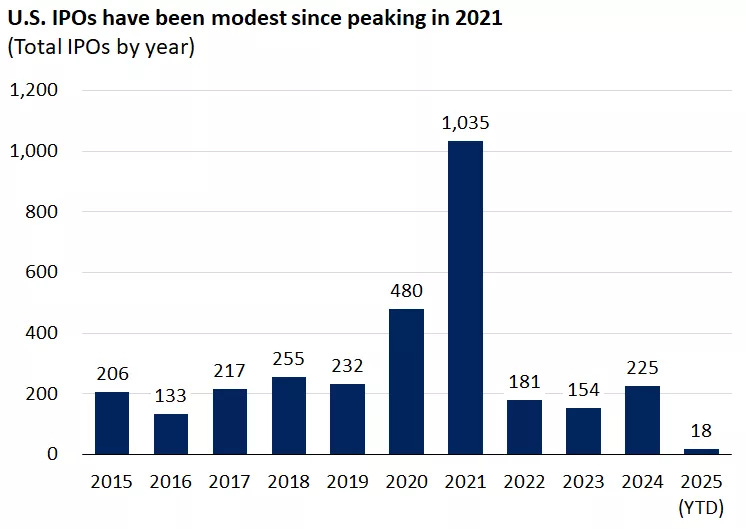

As we enter 2025, a strong fundamental backdrop remains, bolstered by a resilient consumer base and positive trends in economic and earnings growth. This stability should persist as new policies are introduced and may even strengthen as uncertainties begin to diminish.

Nonetheless, for long-term investors, we recommend stepping back and taking a more fundamental view of the investing backdrop. We know over time markets are driven by key fundamental factors, including earnings and economic growth, productivity and innovation, and inflation and interest rates.

Portfolio Rebalancing: Every so often we want to bring our clients back to their target stock and bond allocations. Given the 2-year run in equities many clients had become overweight equities given their personal targets. This is an opportunity to add to bonds that will provide safety and higher yields when the next downturn occurs. This will allow our retirement clients to ensure required cash flows and younger clients the dry powder to add to equities when they are down. All of this while making modest trims to equites after we broke 54 all-time highs in 2024. Clients may see higher than usual trade activity in their accounts because of this.

Economic & Earnings Calendar

We have a packed week of fourth-quarter earnings reports and an interest-rate decision from the Federal Reserve.

The Fed will announce a rate policy decision on Wednesday. Markets are overwhelmingly pricing in no change in interest rates. The focus will be on the press conference with Fed Chair Jerome Powell. However, the ECB is expected to cut its benchmark interest rate target on Thursday.

4th quarter earnings season shifts into high gear this week. On Monday, AT&T reports followed by Boeing, General Motors, Lockheed Martin, and Starbucks on Tuesday.

Wednesday will be busy: ASML Holding, Danaher, General Dynamics, IBM, Lam Research, Meta Platforms, Microsoft, Tesla, T-Mobile US, Waste Management, and Western Digital all report. Apple, Caterpillar, Comcast, Intel, Mastercard, Southwest Airlines, United Parcel Service, and Visapublish quarterly results on Thursday, then Charter Communications, Chevron, and Exxon Mobil close the week on Friday.

Economic data releases to watch next week will include the Census Bureau's durable goods report for December on Tuesday, the Bureau of Economic Analysis' advance estimate of fourth-quarter gross-domestic-product growth on Thursday, and the BEA's personal consumption expenditures price index for December on Friday.

Chart of the Week: Legal immigration is back to pre-pandemic levels.

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.