Our Quarterly Letter

2025 could be the year where bonds outperform stocks. If the market stays turbulent our plan is to use bonds, which we expect to continue to have a positive year, to provide any intermediate term client distributions. For long-term clients who can withstand volatility and endure a bit more discomfort, there will be buying opportunities. As of this writing Monday’s pre-market looks to open down over 4%. Our view for 2025 today is that bonds are likely to outperform stocks, and this will create attractive entry points for stocks eventually.

The largest issue is that US stocks traded at a premium due to their higher-than-average growth expectations, we could have the breaks pumped on that growth. Previously, before these self-imposed setbacks emerged, the outlook across various sectors was quite promising concerning potential growth opportunities. The main issue we faced in these high-growth areas was their higher valuations and consumer prices.

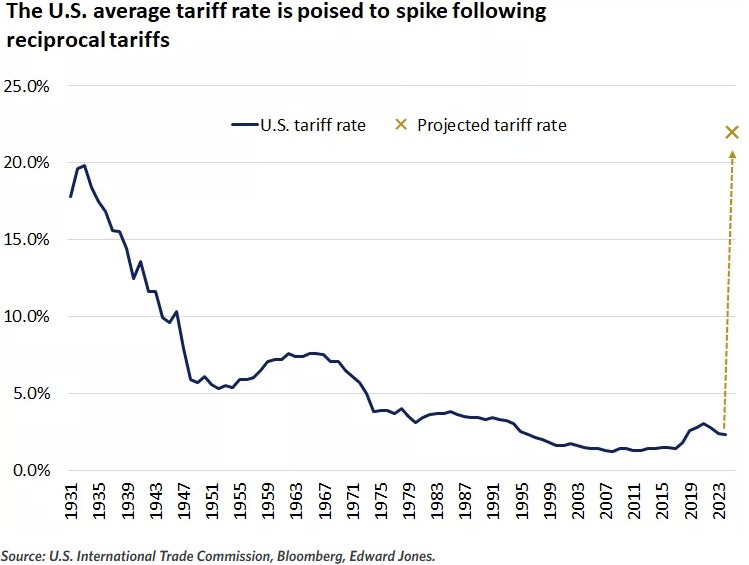

On April 2, President Donald Trump introduced unexpectedly aggressive reciprocal tariff plans. Starting April 5, a minimum 10% tariff will be imposed on all U.S. imports, with higher rates targeting countries with significant trade deficits with the U.S. These changes are projected to increase the effective tariff rate on imports from 2.3% in 2024 to between 20% and 25%, marking the highest level in a century.

In response, China announced matching retaliatory tariffs at a rate of 34%. This announcement, alongside China’s counteraction, sparked risk-off sentiment in the markets, causing equities to drop sharply and U.S. Treasury yields to hit their lowest since October 2024.

While tariffs create challenges for U.S. economic growth and may increase prices in the short term, the U.S. economy is approaching this phase from a position of strength. Furthermore, if labor market conditions show significant weakening, the Federal Reserve is expected to intervene to support the economy with rate cuts. This is a key underpinning of our positive view on bonds, rates go down, bonds generally go up because of duration (Youtube video on duration).

Though market volatility can be unsettling, we advise investors to adhere to their long-term strategies, focusing on quality and diversification. Avoid impulsive decisions driven by emotion, and remember that staying invested generally proves more beneficial than trying to time market entries and exits.

Economic & Earnings Calendar

"Liberation Day" may have passed, but tariffs will continue to dominate headlines and strongly influence market activity next week. As of April 5, a baseline 10% tariff will be applied to all countries, with escalating rates for specific nations, including China, the European Union, Japan, South Korea, and Taiwan, starting Wednesday. China's 34% retaliatory tariffs on all U.S. imports will take effect on Thursday.

Next week also marks the beginning of a busy first-quarter earnings season, with major banks revealing their outcomes. Delta Air Lines will release earnings on Wednesday, CarMax on Thursday, and JPMorgan Chase, Morgan Stanley, and Wells Fargo on Friday.

On the macroeconomic side, the week’s highlight is Thursday’s release of the Bureau of Labor Statistics’ consumer price index. Friday will feature the BLS’s producer price index and the University of Michigan’s consumer sentiment index, which fell to a two-year low in March as long-term inflation expectations hit a multi-decade high.

Additionally, the Federal Open Market Committee will publish the minutes from its mid-March monetary policy meeting on Wednesday.

Chart of the Week: The power of diversification. Chart as of 3/21/2025

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.

Thank you for your wonderful article!

There is one point of contention that the author should consider. In the article, the author uses the term ‘Taiwan, China’. Everyone knows that Taiwan has its own flag, national anthem, passport, currency and army, as well as its own national boundaries. Please consider the universally accepted definition of a country and think about whether Taiwan is an independent country ?