Netflix Benefits from the Hollywood Strikes & Bank Earnings

Weekly Recap

The banking sector has kicked off second-quarter earnings season with better-than-expected results from JPMorgan Chase, Wells Fargo, and Citigroup. Consumer sentiment is at its highest level since September 2021, with its biggest one-month improvement since 2006.

Inflation remains subdued, with the markets pricing in just one more rate hike this year. The Fed funds rate is expected to end the year at 5.25% to 5.50%, a mere 25 basis points higher than the current level. This increase is virtually certain to occur at the Fed’s upcoming meeting.

Despite the positive news, JPMorgan tempered expectations on its earnings call by cautioning against unfounded optimism. JP Morgan’s, Jamie Dimon, had this to say:

The consumer is in good shape, they're spending down their excess cash; that's all tailwinds there. Even if we go into recession, we're going with rather good conditions, low borrowings and good house price values still. But the headwinds are substantial and somewhat unprecedented. There's war in Ukraine, oil gas, quantitative tightening, unprecedented fiscal needs of governments, QT which we never experienced before. And I just think people should take a deep breath on that. We don't know if those things could put us in a soft landing, a mild recession or a hard recession. And obviously, we shall hope for the best

This past week was a strong one for investors and consumers alike. The Nasdaq Composite, S&P 500, and Dow Jones Industrial Average all rose, with the Nasdaq leading the pack with a 3.3% increase - its best week since March. Today, though, the Nasdaq and S&P 500 slipped, suggesting some of the latest good news may be priced in. It looks like the "hope for the best" approach is paying off, but only time will tell if that optimism is well-placed.

Earnings & Economic Calendar

As the second-quarter earnings season kicks off next week, around 60 S&P 500 firms are poised to report their results. Retail sales data and the latest on the US housing market will also be published.

Highlights on Tuesday include financial heavyweights Morgan Stanley, Bank of America and Lockheed Martin, as well as Prologis. Wednesday will see Tesla, Goldman Sachs Group, IBM, Netflix and United Airlines Holdings take to the stage.

Netflix will kick off the second quarter of tech earnings with a plethora of overlapping storylines this Wednesday. The report comes at an unprecedented time, as Hollywood’s actors and writers are on strike together for the first time since Ronald Reagan was head of the Screen Actors Guild. Both groups are focused on improving pay, as well as the streamlining of the entertainment industry due to streaming services.

In response, Netflix is implementing an ad strategy and intensifying their password crackdowns to try and maximize their near- and medium-term financial outlook. However, these moves will not address the saturation of the subscription streaming market or the increased tendency for consumers to take on and cancel subscriptions as they please. Thus, Netflix may need to explore further options.

This quarter, investors will also be keeping a close watch on any guidance Netflix presents regarding potential content spending cuts. The streaming company plans to boost free cash flow, and has said they will increase stock repurchases after buying back $400 million in stock this past March quarter. Of course, these striking writers and actors will be keeping a very close eye as well.

Ironically, a lengthy outage that shuts down U.S. production for months would in fact reduce their costs, thus increasing earnings and margins. Stranger things could certainly happen during this quarter’s earnings. Options trading implies a 10% move out of Netflix after it reports earnings.

On Thursday, Taiwan Semiconductor Manufacturing, Johnson & Johnson, Newmont and American Airlines Group are due to issue earnings, with American Express set to wrap up the week on Friday.

Of interest to our clients, Synchrony Financial reports on Tuesday and options are implying a 5% move. Intuitive Surgical, a new purchase for our clients, reports on Thursday and options imply close to a 6% move.

On Tuesday, the U.S. Census Bureau will release its report on June retail sales. Analysts expect the data to show a 0.4% increase in consumer spending compared to May.

The National Association of Home Builders will also release their housing market index for July on Tuesday. Additionally, the Census Bureau is reporting June housing starts on Wednesday and the National Association of Realtors is providing data on existing-home sales in June on Thursday.

Finally, the Conference Board's leading economic index for June will be released on Thursday. This comes after 14-consecutive months of decreases in this crucial indicator.

Inflation Tempered

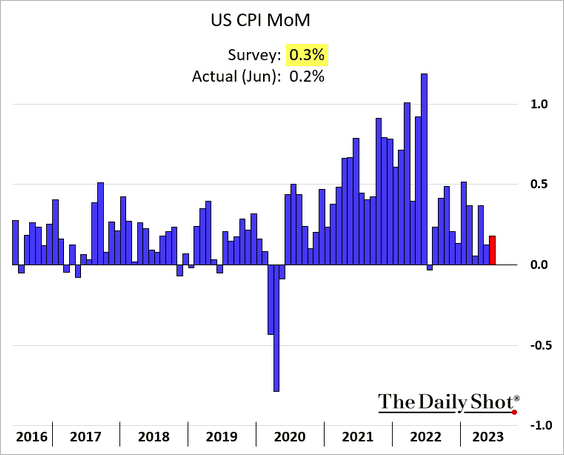

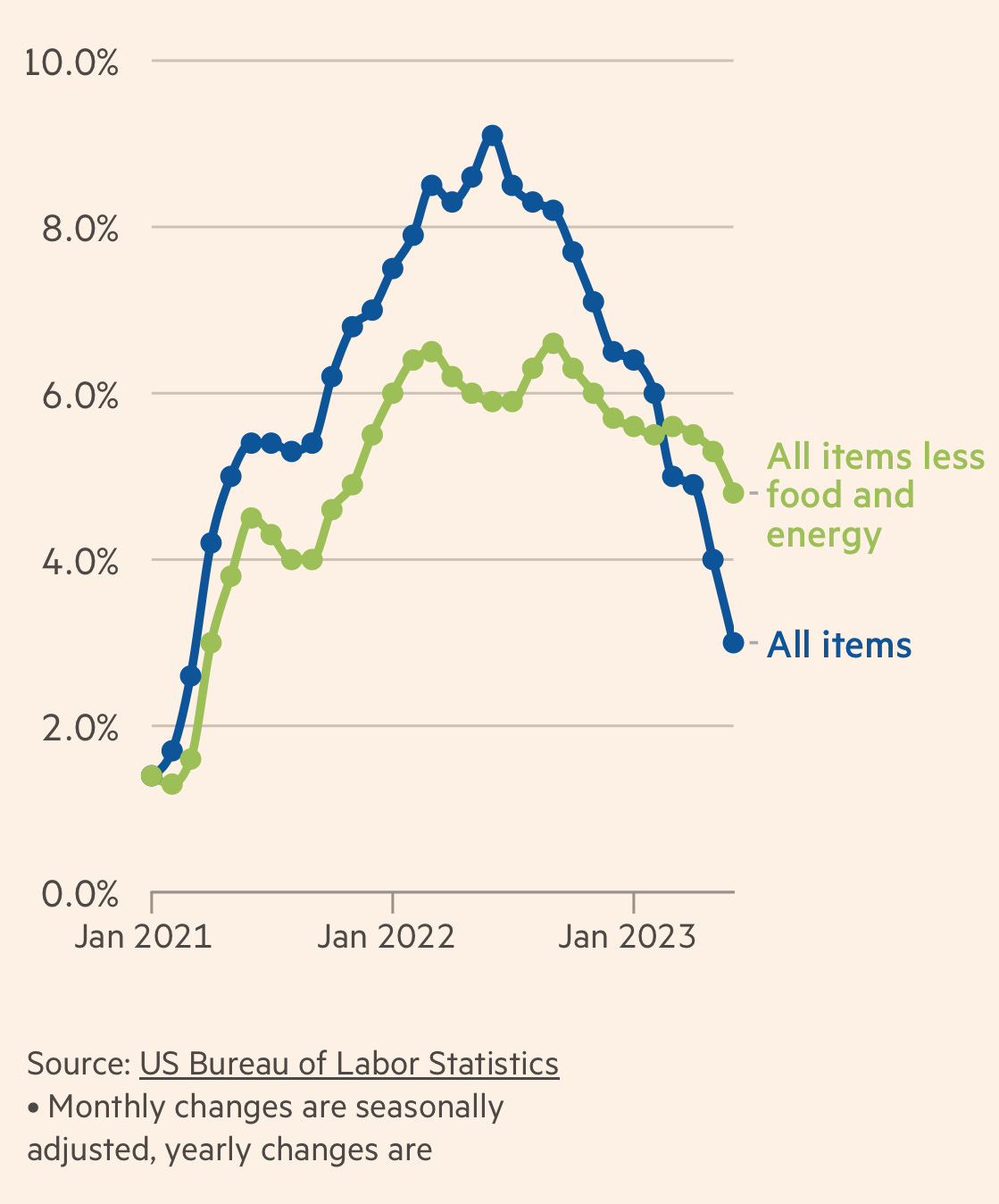

The latest figures released by the Federal Reserve show that US inflation dropped to 3% in June, lower than expected. In the past month, this is the slowest rate of inflation since March 2021. Prices rose 0.2% compared to 0.1% the previous month, however this was lower than the predicted figure.

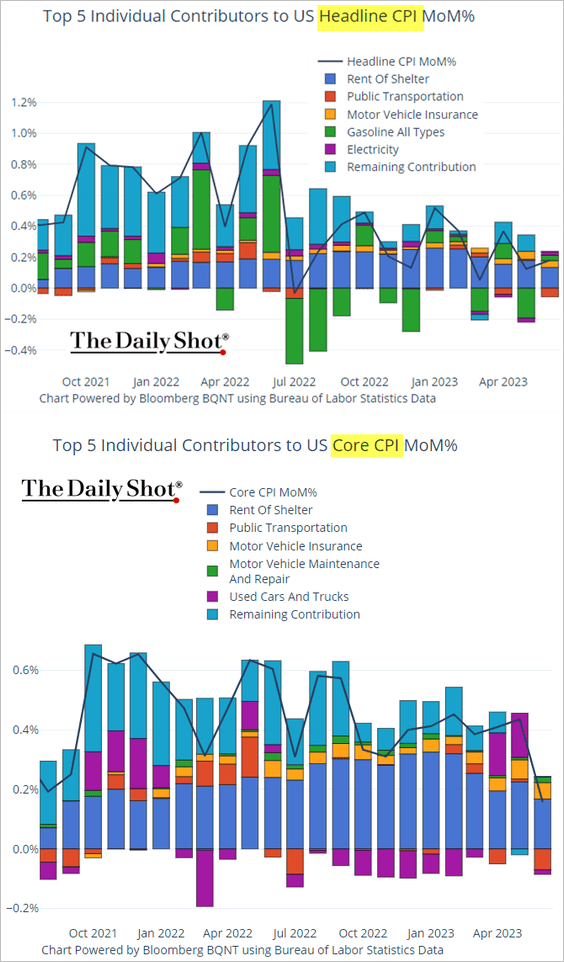

The core CPI, which excludes volatile food and energy prices, dropped to 4.8%. This is a decrease from the 5.3% seen in May with monthly increases of 0.2%, down from the previous month's 0.4%.

The figures show that the Federal Reserve's interest rate rises are having an impact on price pressures. The annual figure was further helped by large increases from the previous year dropping out of calculations.

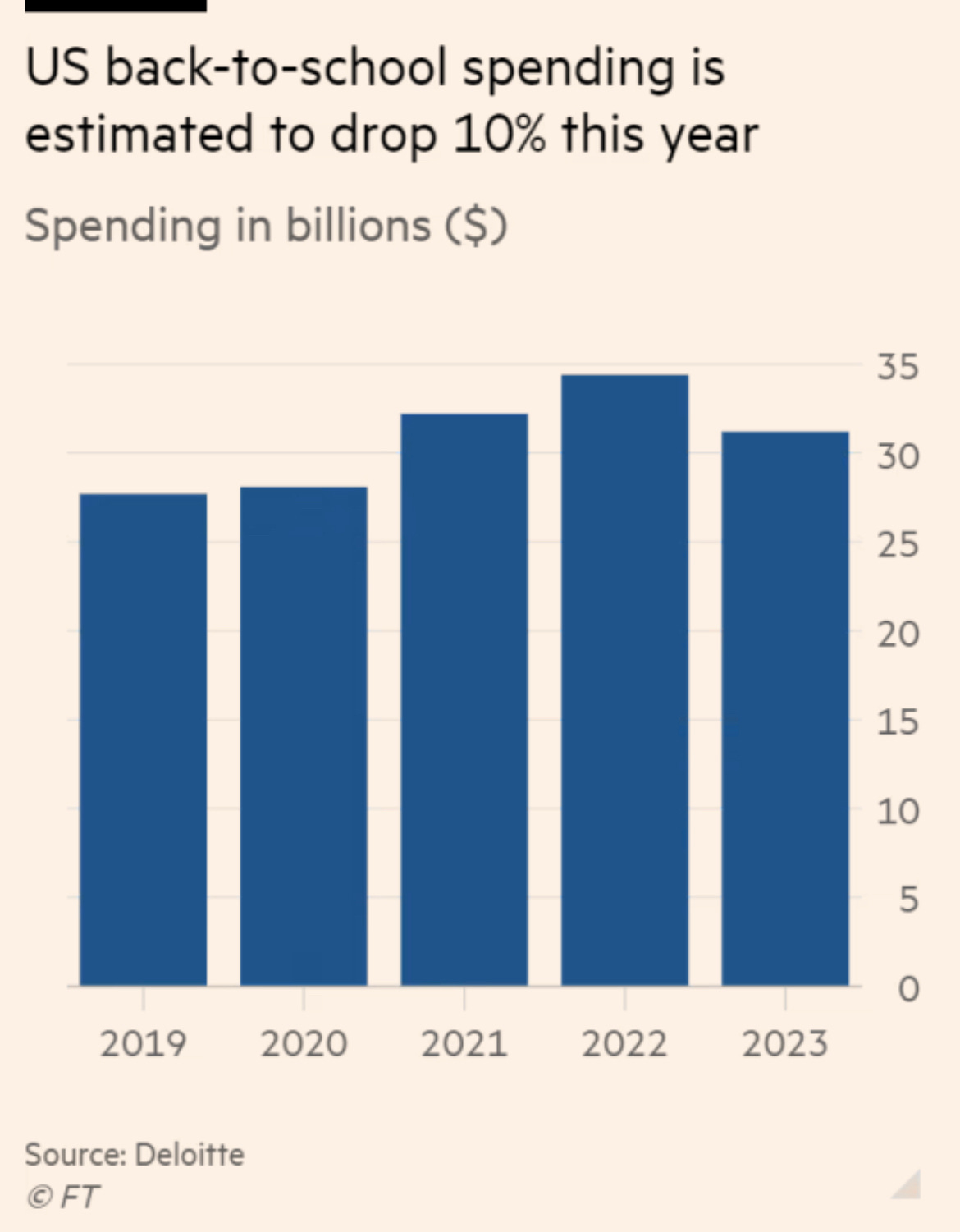

Chart of the Week: Back to school budgets slashed

As the impact of inflation is becoming increasingly apparent, US consumers are cutting back on their back-to-school budgets. Based on a survey of 1,212 parents, Deloitte's latest report shows that families on average will spend 10% less per student this year compared to 2022. The total spending across the nation is forecasted to be $31.2 billion, averaging $597 per child. The retail sector is set to face a challenge in light of this more cautious consumer mindset.

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.