Key Inflation Data in Focus

Week in Review

Trade and tariff uncertainties continue to loom as one of the most significant concerns for the markets. Although U.S. tariffs on Canada and Mexico are currently on hold and tariffs on China remain at 10%, a substantial escalation could trigger inflationary pressures and dampen growth.

From a portfolio management perspective, diversification in the coming year is crucial to mitigating political uncertainties and potential market volatility. Investing across various sectors and asset classes, including U.S. large-cap and mid-cap stocks as well as investment-grade bonds, can help cushion against significant drawdowns in any single area.

Following a strong finish to 2024—with fourth-quarter GDP growth reaching an annualized rate of 2.3% and full-year growth at 2.8%—the first quarter of 2025 is also on track for above-trend growth. The Federal Reserve's GDP-Now tracker forecasts a robust growth rate of 2.9% for the first quarter, significantly exceeding the trend rates of 1.5% to 2.0%.

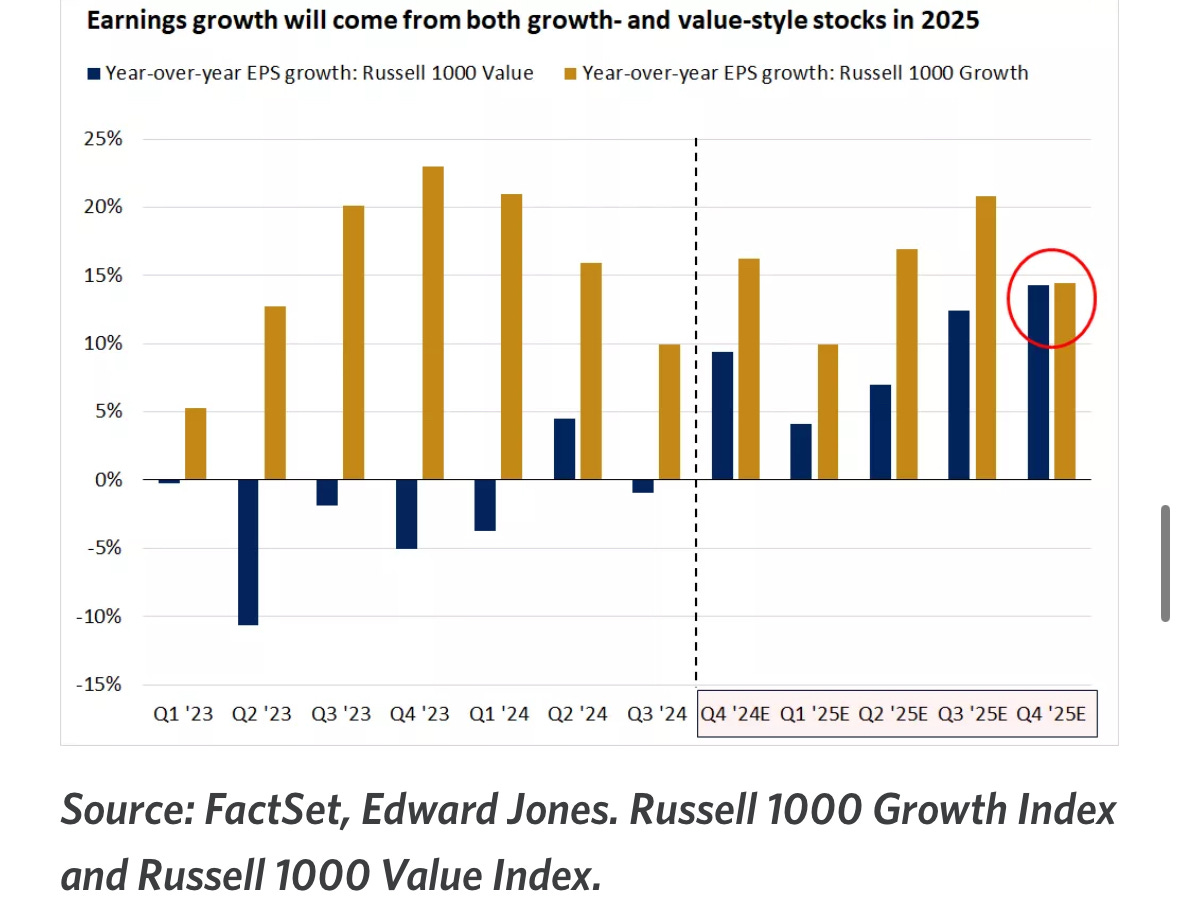

A key factor influencing stock market performance is the trajectory of corporate earnings. We anticipate that earnings in 2025 will grow by 10%-15% year-over-year, marking the highest increase since 2021. We expect contributions from both growth and value sectors, supporting a continued broadening of sector leadership in the stock market.

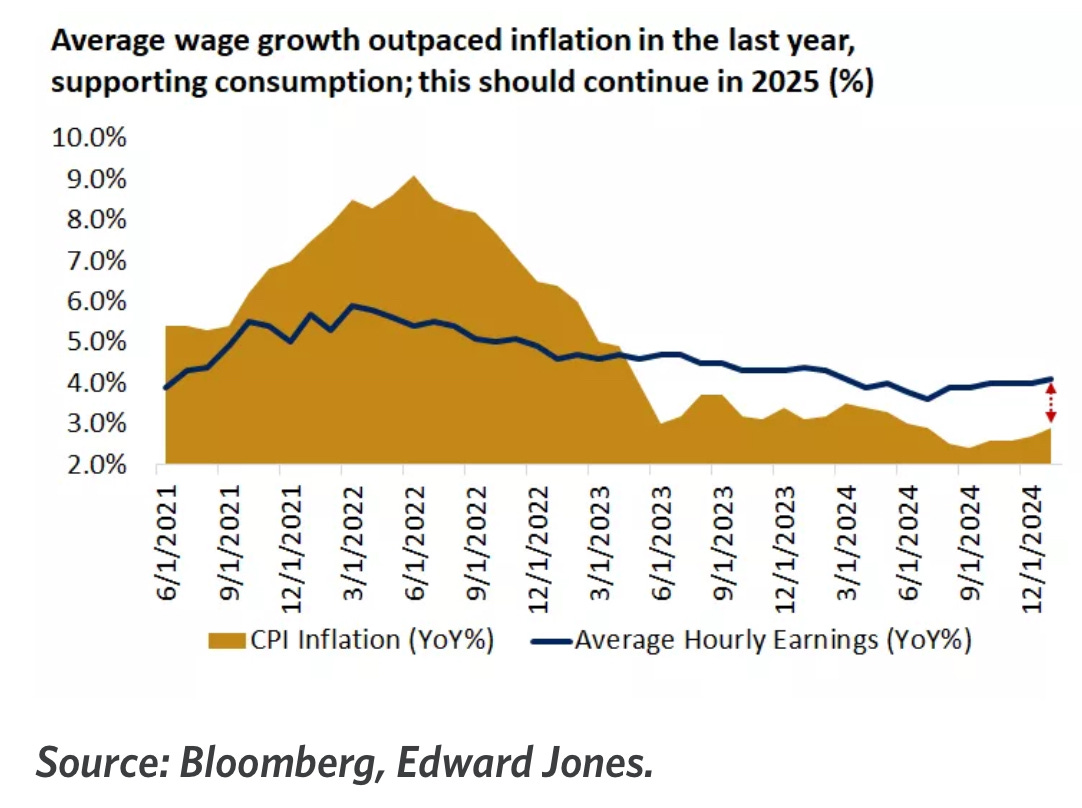

Lastly, the U.S. nonfarm jobs report for January indicates a resilient labor market. When households feel secure in their jobs and the broader job market, their propensity to spend increases, which is a positive signal for the economy.

Economic & Earnings Calendar

Next week, investors will focus on the latest inflation figures and a slew of fourth-quarter earnings reports. The Bureau of Labor Statistics will release the Consumer Price Index (CPI) for January on Wednesday, which is expected to come in at 2.9%.

Our concern this week is that any positive news on inflation will be drowned out by tariff news. As with stocks, future guidance is more important than past results.

With the Federal Reserve's interest rate reductions currently paused, investors will wait for further progress in curbing inflation. On Thursday, the BLS is set to publish the Producer Price Index (PPI) for January.

Additional economic indicators to monitor next week include the National Federation of Independent Business' Small Business Optimism Index for January, which will be available on Tuesday, and the Census Bureau's retail sales data for January, scheduled for release on Friday.

Earnings announcements will begin with McDonald's on Monday, followed by Coca-Cola, DoorDash, Marriott International, Shopify, and Super Micro Computer on Tuesday. On Wednesday, Cisco Systems, Robinhood, Ventas, and Vertiv Holdings will reveal their results.

Airbnb, Applied Materials, Coinbase Global, Deere, Wynn Resorts, and Zoetis will publish their earnings on Thursday, while Enbridge and Moderna will wrap up the week with their reports on Friday.

Chart of the Week: Year to date, the tech sector has lagged the overall market.

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.