Dovish Comments By The Fed Offset Debt Ceiling Worries… For Now

Dovish Comments By The Fed Offset Debt Ceiling Worries… For Now

The stock market finished the week in positive territory, with the Nasdaq leading the way with a 3% gain, followed by the S&P 500 up 1.5%, and the Dow Jones up a meager 0.2%. This was despite lingering worries over potential defaults. This follows a trend we have seen since the start of the year with growth stocks outperforming their value counterparts.

It appears that potentially dovish comments from Federal Reserve Chairman Jerome Powell have helped offset the default worries. Speaking at a Fed-hosted conference, Powell said that banking trouble was likely creating tighter credit conditions. That offers investors hope that the Fed may finally be ready to make its long-awaited pause in interest rate hikes.

Traders have started to reassess the likelihood of an interest rate hike at the next Federal Reserve meeting on June 13 and 14. Fed futures now suggest an 81% chance of a rate pause, up from 64% just one day ago.

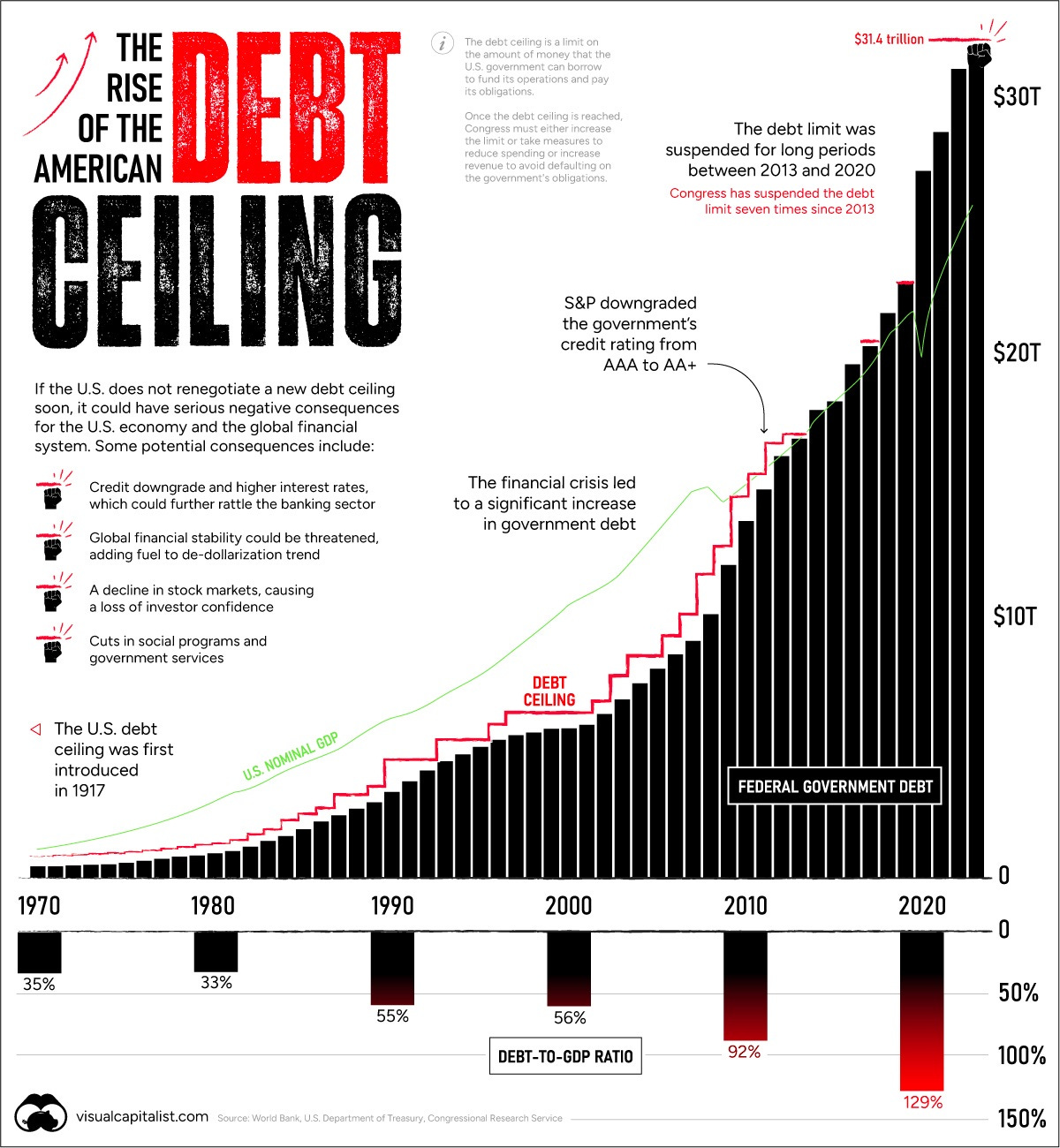

The chances of a rate hike could be even lower if President Joe Biden and House Republicans fail to come to an agreement on raising the debt ceiling before June 1. That's just 11 days away, so the clock is ticking!

Earnings & Economic Calendar

Next week is jam-packed with market-moving economic data, Federal Reserve meeting minutes, and the first quarter earnings reports of top retailers and technology firms.

Monday kicks off with Zoom Video Communications announcing its results, followed by AutoZone, Intuit, and Lowe’s on Tuesday. On Wednesday, Analog Devices and Snowflake are set to publish their quarterly numbers.

Thursday will be an extra busy day, with Best Buy, Costco Wholesale, Dollar Tree, Marvell Technology, Ulta Beauty, and Workday all publishing their financials.

Meanwhile, JPMorgan Chase, Ford Motor, PG&E, Thermo Fisher Scientific, and Zoetis will be hosting investor days on Monday, Tuesday, and Thursday respectively. We will be looking for comments out of JP Morgan to see how they may have benefited from the recent banking crisis.

Next week will be an important one for economic data. On Wednesday, the Federal Open Market Committee will release the minutes from its early-May monetary-policy meeting. Investors will be carefully analyzing the documents for clues about when officials might pause their interest-rate increases.

On Friday, the Bureau of Economic Analysis will report April’s personal income and expenditures, both of which are expected to be higher than the month before. The release will also include the core personal-consumption expenditures price index, which the Fed watches closely – it is forecast to slow to 4.4% year over year.

Other noteworthy economic data out next week includes S&P Global’s manufacturing and services purchasing managers’ indexes for May, both of which are predicted to decline from April readings. The Census Bureau will also release the durable goods report for April on Friday.

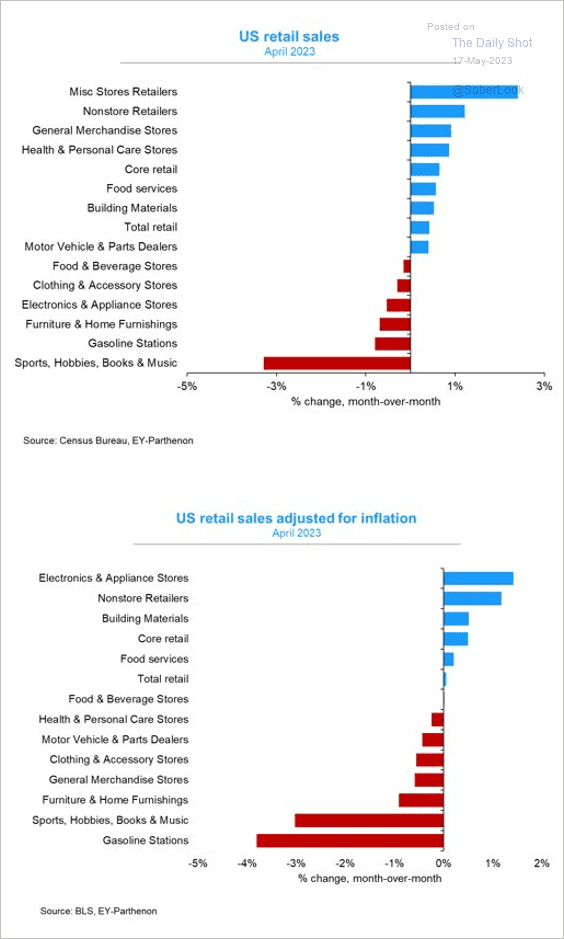

Chart of the Week: Last month, retail sales rose by 0.4%, below economists' predictions of a 0.8% increase. This follows a 0.7% decrease in March. Retail sales consist of goods that are not adjusted for inflation. Lower prices at auto dealerships were thought to be the cause of the slower-than-expected increase in receipts. Automobile manufacturers reported a jump in unit sales in April. In our view, the tepid retail sales growth is another indicator the Fed will pause hikes.

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.