Bank Earnings Continue & Our First Financial Planning Tip of 2024

Week in Review

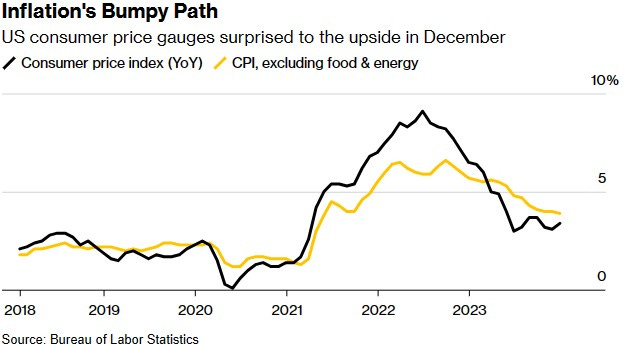

Inflation in the US has gained speed in December, boosted by persistent costs for services while the drop in prices for goods came to a halt. Reversing the decrease seen in recent months. The consumer price index rose by 3.4% in the twelve months leading up to December. The index rose more than expected on a monthly basis, driven by a rise in housing costs, increased expenses for transportation, and a rebound in energy prices for the first time since September.

Both the Fed policymakers and economists on Wall Street are beginning to question the sustainability of the recent downward trend in prices, which has largely been attributed to improvements in supply chains.

After the data was reported Thursday odds of the 1st rate cut happening in March were cut in half. We still believe rate cuts will happen in 2024, however. One month of stronger than expected inflation should not reverse the downward trend in our view. The road to a return to 2% inflation is bumpy, and the last mile could be difficult.

A significant portion of the unanticipated increase in core goods prices, which excludes energy and food, can be attributed to rises in used car and apparel prices, despite end-of-year sales and promotions. Additionally, prices for services have remained steady, particularly in the categories of housing and car insurance, which saw the highest year-on-year increase since 1976.

The cost of shelter, which accounts for approximately one-third of the overall CPI index and contributed to more than half of its overall rise, went up by 0.5% in December. This included a rise in hotel prices, which were lower in the previous month. Economists believe that a sustained decrease in this category is crucial in bringing core inflation back down to the Fed's target.

On Friday, business inflation (known as PPI) was reported, and prices unexpectedly fell in December amid declining costs for goods such as diesel fuel and food, suggesting inflation would continue to subside and allow the Federal Reserve to start cutting interest rates this year. This implies that an uptick in consumer prices last month was likely a blip.

Lastly, JPMorgan kicked off earnings season and reported earnings, missing estimates. In our view this was due to one-time charges the bank incurred, obscuring otherwise good results.

Financial Planning Tip: Retirement Contributions for 2024

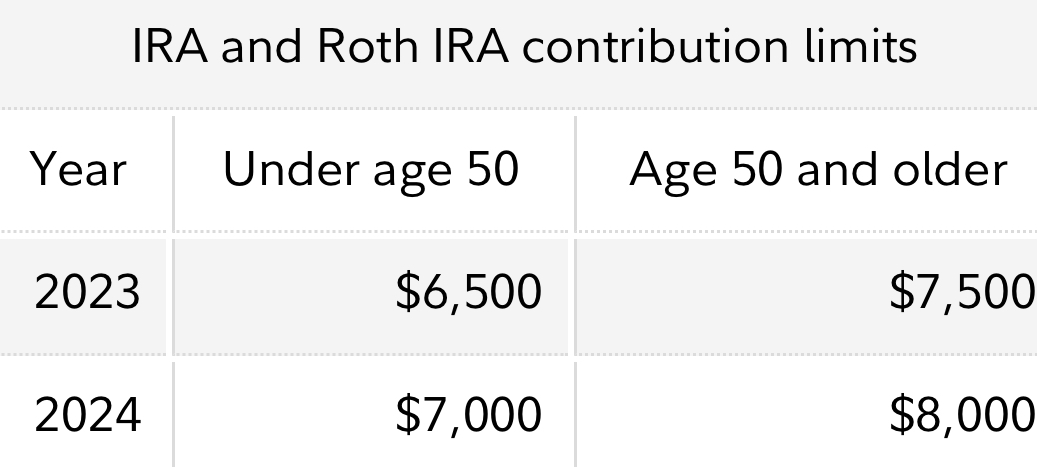

The IRA contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. You can make 2024 IRA contributions until the federal tax deadline (for income earned in 2024).

Unlike with a Roth IRA, there's no income limit for those who can contribute to a traditional IRA. But your income and your (as well as your spouse's) affects whether you can deduct your traditional IRA contributions from your taxable income for the year. For those married filing jointly in 2024 you can get an income deduction if your income is below $143k.

Earnings & Economic Calendar

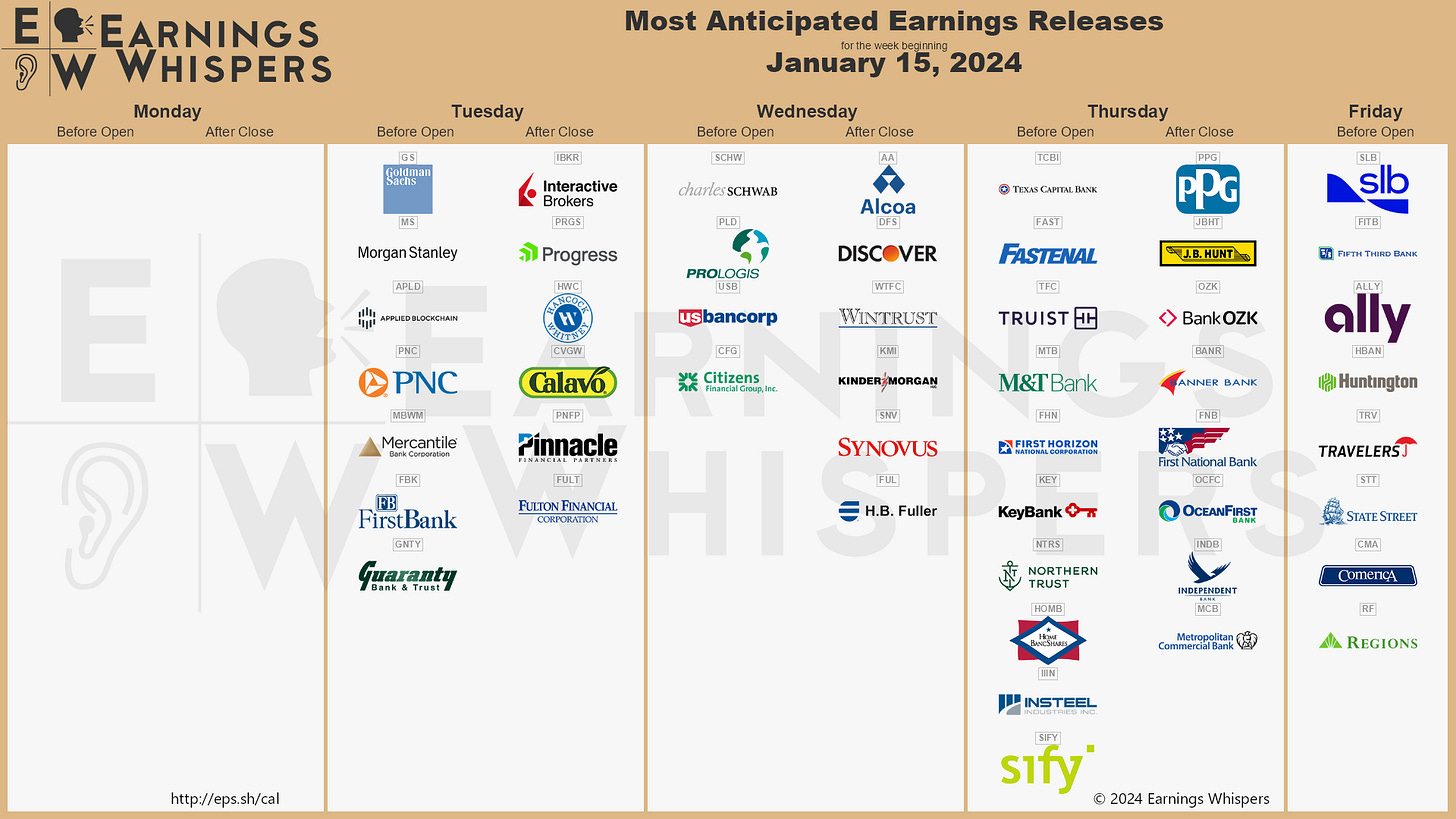

On Tuesday, banks continue the start of earnings season. Investors will hear from Goldman Sachs and Morgan Stanley. Wednesday will see Charles Schwab and Prologis reporting their quarterly results, followed by Fastenal, J.B. Hunt Transport Services, and Truist Financial on Thursday. The week will wrap up with Schlumberger, State Street, and Travelers reporting their earnings on Friday.

We will also be keeping an eye on key economic data. On Wednesday, the Census Bureau will release retail sales data for December, providing insight into consumer spending during the holiday season. Also on Wednesday, the Federal Reserve will publish its first beige book of 2024, offering a comprehensive look at economic conditions across the country. Friday will bring the University of Michigan's Consumer Sentiment survey for January, providing valuable information on consumer confidence.

The U.S. housing market will also be in focus next week, with three important reports being released. On Wednesday, the National Association of Home Builders will release its housing market index for January. Thursday will see the Census Bureau reporting new residential construction statistics for December. Finally, on Friday, the National Association of Realtors will report existing-home sales for the previous month.

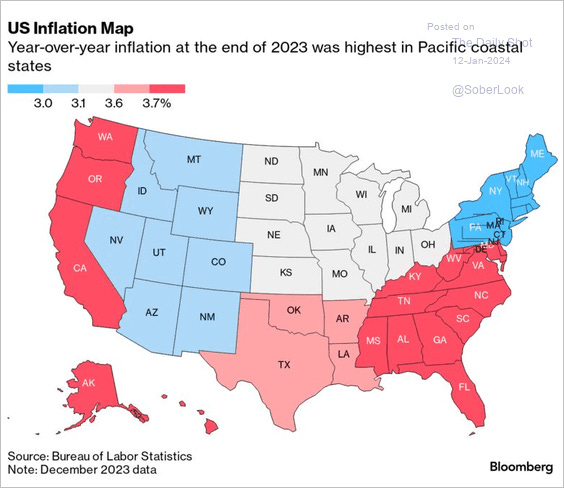

Chart of the Week: US Inflation by State

Disclaimer: The author of this blog is a financial advisor but may not be the right advisor for you. In fact, the author may not even be the right advisor for themselves. Please consult a qualified professional before making any financial decisions based on the content of this blog. And remember, just because the author has a fancy title and a briefcase full of spreadsheets, doesn't mean they know what they're doing.