I’m thankful for a successful year at WinCap Financial, our clients, and for 200+ regular readers we now have. If you enjoy the content, take a second and throw it a “like” below. Happy Thanksgiving!

As a client's wealth manager, we are charged with the responsibility of ensuring that our clients' money is grown and protected. A key driver of how we allocate assets between stocks and bonds is the expected portfolio withdrawals of our clients.

The allocation of assets between stocks and bonds is driven by a variety of factors, but one of the most important is expected portfolio withdrawals. Withdrawals can come in the form of living expenses, planned purchases, or unplanned events such as medical emergencies. They can also be a result of market conditions, such as when investors need to sell assets to raise cash in a down market.

Withdrawals have a big impact on portfolio performance, and so they must be carefully considered when making investment decisions. The amount that a client expects to withdraw from their portfolio will impact how much risk they are willing to take on. For example, a retiree who is expected to make regular withdrawals to cover living expenses will need to be more conservative in their asset allocation than someone with a longer time horizon who can afford to take on more risk.

Withdrawals must also be factored into the rebalancing process. If a client is withdrawing funds on a regular basis, their portfolio will become increasingly skewed. We also consider market performance when taking withdrawals. If the market is healthy we will likely pull from stocks, if the environment is turbulent then bonds will provide the funding. If not careful, this can have a negative impact on returns, so it is important to rebalance the portfolio on a regular basis to ensure that the asset allocation remains in line with the client's goals.

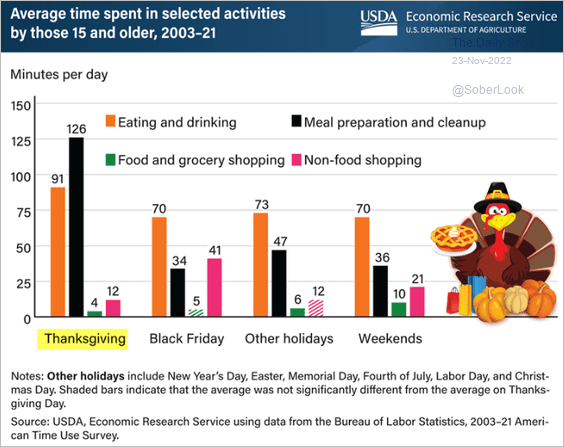

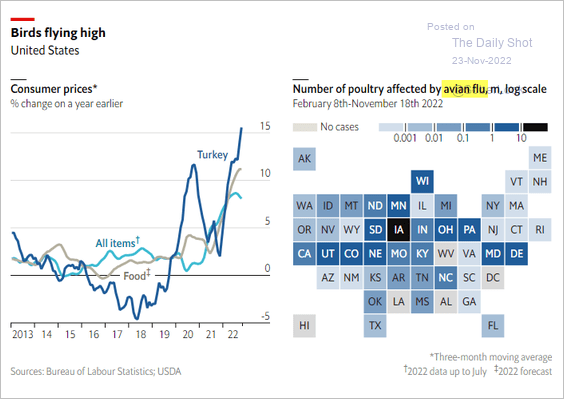

Some Thanksgiving charts: